NFIP Newly Mapped Eligibility: Difference between revisions

No edit summary |

No edit summary |

||

| (One intermediate revision by the same user not shown) | |||

| Line 41: | Line 41: | ||

== Flood Map Changes == | == Flood Map Changes == | ||

First, there must be a '''Physical Map Revision''' of a Flood Insurance Rate Map (FIRM). A building mapped into a [[Special Flood Hazard Area]] on the community's initial FIRM does not qualify for this discount. | First, there must be a '''Physical Map Revision''' of a Flood Insurance Rate Map (FIRM). A building mapped into a [[Special Flood Hazard Area]] on the community's initial FIRM does not qualify for this discount. In other words, buildings previously located in an [[Emergency Program]] community do not qualify. | ||

[[File:Img-FEMA-Map Change-01.png|400px|link=]] | [[File:Img-FEMA-Map Change-01.png|400px|link=]] | ||

| Line 62: | Line 62: | ||

| A new Flood Insurance Rate Map (FIRM) was created for the community that placed the home in '''Zone AE''' (a SFHA). | | A new Flood Insurance Rate Map (FIRM) was created for the community that placed the home in '''Zone AE''' (a SFHA). | ||

|- | |- | ||

| colspan = 2 style="background:#d3eddb;" | '''Example 2: Zone | | colspan = 2 style="background:#d3eddb;" | '''Example 2: Zone D to Zone A99''' | ||

|- | |- | ||

| A | | A rural property was in '''Zone D''', which carries an undetermined flood risk and does not require flood insurance for federally backed loans. | ||

| | | The FIRM was updated to show an under-construction levee that will eventually reduce the zone to a non-SFHA. However, until the levee's completion, the zone was designated as A99, a SFHA. | ||

|} | |} | ||

Latest revision as of 13:33, 18 February 2025

The Newly Mapped Discount allows NFIP policyholders to qualify for a Statutory Discount when a building's flood zone designation changes due to a FEMA map revision. This discount reduces the policy premium without changing the rating, provided the eligibility requirements are met.

Eligibility Requirements

To qualify for the Newly Mapped Discount, the following conditions must be satisfied:

| Requirement | Description |

|---|---|

| FEMA Flood Map Change | The exception applies only when NFIP Maps are revised. |

| New SFHA Designation | The revision results in a building being newly designated within a Special Flood Hazard Area where it was previously not in one. |

| Application within 12 Months | The insurer must receive the Application Form and the full amount due within 12 months from the effective date of the flood map revision. |

| Application within 24 Months | The insurer must receive the Application Form, the full amount due, and a lender's letter requiring flood insurance coverage dated within 45 days from the effective date of the flood map revision. [1] |

| Eligible Buildings | The exception applies to all eligible buildings, including those owned by condominium associations. |

If these eligibility requirements are not met, then the Newly Mapped Discount will not apply.

Validation with Flood Zone Determinations

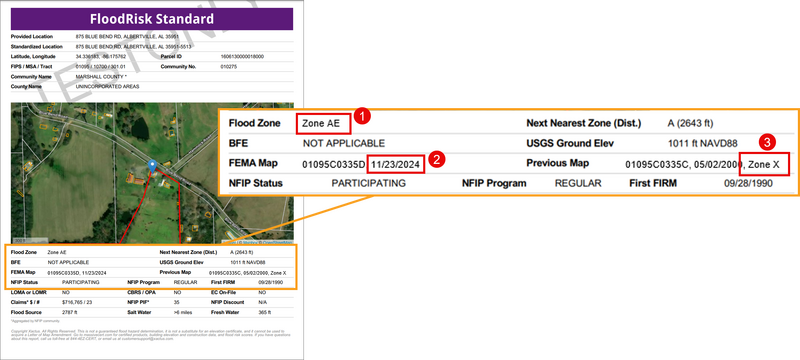

Flood Zone Determinations can be used to validate eligibility for the Newly Mapped Discount.

Three areas on the document should be reviewed to confirm eligibility.

- Current Flood Zone

- Current Map Revision Date

- Prior Flood Zone

In the image above, the property is eligible for the Newly Mapped Discount so long as application/request and premium are received on or before November 23, 2025.

Review the sections below for more information about how these details confirm eligibility.

Flood Map Changes

First, there must be a Physical Map Revision of a Flood Insurance Rate Map (FIRM). A building mapped into a Special Flood Hazard Area on the community's initial FIRM does not qualify for this discount. In other words, buildings previously located in an Emergency Program community do not qualify.

Next, the Physical Map Revision must result in a new SFHA designation for a specific building. This can be done one of two ways:

- The previous flood zone was previously in zone B, C, or X and then remapped to a SFHA.

- The previous flood zone was previously in zone D, AR, or A99 and then remapped to a different SFHA.

Eligible Scenarios

| Before the Map Revision | After the Map Revision |

|---|---|

| Example 1: Zone B to Zone AE | |

| A homeowner’s property was located in an Emergency Program community with a Flood Hazard Boundary Map (FHBM). | A new Flood Insurance Rate Map (FIRM) was created for the community that placed the home in Zone AE (a SFHA). |

| Example 2: Zone D to Zone A99 | |

| A rural property was in Zone D, which carries an undetermined flood risk and does not require flood insurance for federally backed loans. | The FIRM was updated to show an under-construction levee that will eventually reduce the zone to a non-SFHA. However, until the levee's completion, the zone was designated as A99, a SFHA. |

Ineligible Scenarios

| Before the Map Revision | After the Map Revision | Criteria for Ineligibility |

|---|---|---|

| Example 1: FHBM to FIRM/Zone X | ||

| A homeowner’s property was located in an Emergency Program community with a Flood Hazard Boundary Map (FHBM). | A new Flood Insurance Rate Map (FIRM) was created for the community that placed the home in Zone X (a Non-SFHA). | Although there was a Physical Map Revision, the property is in a Non-SFHA. NFIP coverage is voluntary. |

| Example 2: Zone AE to Zone VE | ||

| A coastal property was in Zone AE, which carries a moderate flood risk. | Due to erosion and updated flood modeling, FEMA reclassifies the area as Zone VE, a high-risk coastal flood zone. | The property was already in a SFHA prior to the map revision. |

| Example 3: Zone AE to Zone C | ||

| An urban property was in Zone AE, which carries a moderate flood risk. | Due to community earthworks projects, FEMA reclassifies the area as Zone C, a low risk zone. | The zone went from a SFHA to a Non-SFHA, making NFIP coverage optional. |

Lender's Notification

Finally, the insurer must receive the Application Form and full premium payment within 12 months of the effective date of the Physical Map Revision unless a lender's notification (usually a mailed letter) accompanies the application.

The policyholder applied for the policy within 45 days of initial lender notification, if the notification occurred within 24 months of the effective FIRM revision date. Note: The insurer must retain a copy of the lender notification in the underwriting file.

A lender's notification allows the 12-month eligibility period to be extended to 24 months. A copy of the document must be uploaded to the policy.