Statutory Discounts: Difference between revisions

No edit summary |

|||

| (12 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

'''Statutory discounts''' are legislated incentives within the [[NFIP]] designed to encourage participation and ensure affordability for policyholders while they transition to full risk rating. Statutory discounts are slowly phased out over number of policy terms. | |||

'''Statutory discounts''' are legislated incentives within the NFIP designed to encourage participation and ensure affordability for policyholders while they transition to full risk rating. Statutory discounts are slowly phased out over number of policy terms. | |||

== Glide Path == | == Glide Path == | ||

| Line 8: | Line 7: | ||

* Lapses in coverage or other scenarios will result in losing statutory discounts. | * Lapses in coverage or other scenarios will result in losing statutory discounts. | ||

== Types == | == Discount Types == | ||

=== Pre-FIRM Discount === | === Pre-FIRM Discount === | ||

The '''Pre-FIRM discount''' applies to buildings constructed before the community's [[FIRM Date]], marking its participation in the NFIP's regular program. Buildings are designated as "Pre-FIRM" if constructed prior to this date and "Post-FIRM" if built after the FIRM Date. | The '''Pre-FIRM discount''' applies to buildings constructed before the community's [[FIRM Date]], marking its participation in the NFIP's regular program. Buildings are designated as "Pre-FIRM" if constructed prior to this date and "Post-FIRM" if built after the FIRM Date. | ||

* Applies to buildings constructed before a community joined the NFIP. | * Applies to buildings constructed before a community joined the NFIP. | ||

* | * Building must be the policyholder's '''primary residence''' to qualify. | ||

* Phased out via the glide path | * Phased out via the glide path. | ||

=== Newly Mapped Discount === | === Newly Mapped Discount === | ||

| Line 24: | Line 23: | ||

===Annual Increase Cap Discount === | ===Annual Increase Cap Discount === | ||

The '''Annual Increase Cap''' discount is not outlined clearly in the Flood Insurance Manual, although it is mentioned in passing. [https://www.fema.gov/sites/default/files/documents/fema_nfip_flood-insurance-manual_042024.pdf#page= | The '''Annual Increase Cap''' discount is not outlined clearly in the Flood Insurance Manual, although it is mentioned in passing. [https://www.fema.gov/sites/default/files/documents/fema_nfip_flood-insurance-manual_042024.pdf#page=142] | ||

It serves as a mechanism to phase in premium increases gradually. This prevents a sudden, significant cost hike for policyholders transitioning from legacy rating methodologies or other subsidized rates. The glidepath ensures a gradual adjustment to actuarial rates for existing coverage holders. The Annual Increase Cap is categorized as its own type of discount in NFIP calculations. | It serves as a mechanism to phase in premium increases gradually. This prevents a sudden, significant cost hike for policyholders transitioning from legacy rating methodologies or other subsidized rates. The glidepath ensures a gradual adjustment to actuarial rates for existing coverage holders. The Annual Increase Cap is categorized as its own type of discount in NFIP calculations. | ||

It ensures policyholders don’t experience abrupt shifts from heavily subsidized rates to full actuarial costs. | It ensures policyholders don’t experience abrupt shifts from heavily subsidized rates to full actuarial costs. | ||

[[File:Img-tlm-glidepath-01.png|left|800px|link=]] | |||

{{clear}} | |||

==== Conditions That Can Remove the Discount ==== | ==== Conditions That Can Remove the Discount ==== | ||

* A '''lapse in coverage''' is the most common reason for losing the Annual Increase Cap | * A '''lapse in coverage''' is the most common reason for losing the Annual Increase Cap | ||

* | * A building that transitions from '''under construction to finished construction''' | ||

* A [[Policy Form]] update or correction | |||

* A property address correction, if keyed incorrectly | |||

The Annual Increase Cap is integral to balancing affordability and actuarial soundness, ensuring a smooth rate transition for policyholders without immediate full-cost burdens. | The Annual Increase Cap is integral to balancing affordability and actuarial soundness, ensuring a smooth rate transition for policyholders without immediate full-cost burdens. | ||

=== Real Estate Transaction | === Real Estate Transaction === | ||

The '''Real Estate Transaction | The '''New Policy After a Real Estate Transaction rule''' [https://www.fema.gov/sites/default/files/documents/fema_nfip_flood-insurance-manual_042024.pdf#page=113] allows statutory discounts to transfer to a new NFIP policy when a property changes ownership, provided the sale occurred within the last year. Instead of requiring prior declarations pages, eligibility is established using settlement documents or deeds, ensuring continuity of coverage benefits for the new owner. | ||

* Transferable discounts for properties insured under an NFIP policy and sold within the last year. | * Transferable discounts for properties insured under an NFIP policy and sold within the last year. | ||

* | * Closing paperwork required | ||

* No prior declarations page required | * No prior declarations page required | ||

{{nfip}} | {{nfip}} | ||

Latest revision as of 08:19, 21 February 2025

Statutory discounts are legislated incentives within the NFIP designed to encourage participation and ensure affordability for policyholders while they transition to full risk rating. Statutory discounts are slowly phased out over number of policy terms.

Glide Path

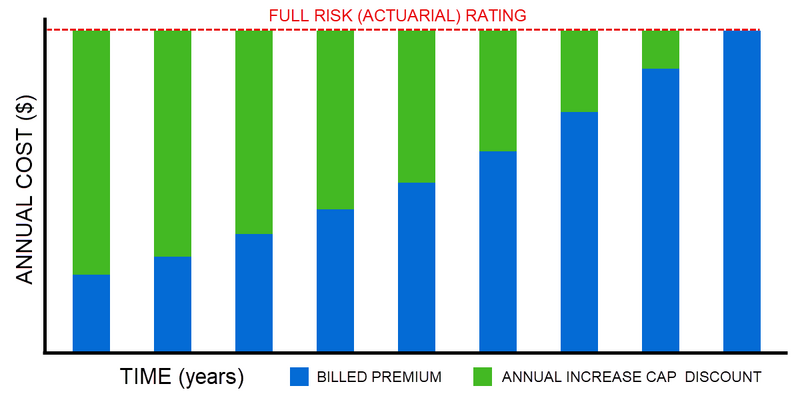

The glide path is a phased approach used to gradually eliminate subsidies provided through NFIP statutory discounts. Under this method, policyholders see annual premium increases capped at 18–25%, ensuring a manageable transition from lower premiums to actuarial-based pricing while maintaining affordability over time.

- Annual increase caps prevent steep rate hikes.

- Capped rate increases balance affordability with transitioning to actuarial rates.

- Lapses in coverage or other scenarios will result in losing statutory discounts.

Discount Types

Pre-FIRM Discount

The Pre-FIRM discount applies to buildings constructed before the community's FIRM Date, marking its participation in the NFIP's regular program. Buildings are designated as "Pre-FIRM" if constructed prior to this date and "Post-FIRM" if built after the FIRM Date.

- Applies to buildings constructed before a community joined the NFIP.

- Building must be the policyholder's primary residence to qualify.

- Phased out via the glide path.

Newly Mapped Discount

The Newly Mapped discount applies to buildings reclassified from low-risk areas (non-Special Flood Hazard Areas) to high-risk areas (Special Flood Hazard Areas) due to updated flood mapping. This discount allows affected property owners to phase into higher premiums gradually using the glide path, making the transition to mandatory flood insurance requirements more affordable.

- Applies to properties reclassified from low-risk to high-risk areas.

- Allows gradual premium increases using the glide path.

- Ensures affordability as homeowners transition to mandatory flood insurance requirements.

Annual Increase Cap Discount

The Annual Increase Cap discount is not outlined clearly in the Flood Insurance Manual, although it is mentioned in passing. [1]

It serves as a mechanism to phase in premium increases gradually. This prevents a sudden, significant cost hike for policyholders transitioning from legacy rating methodologies or other subsidized rates. The glidepath ensures a gradual adjustment to actuarial rates for existing coverage holders. The Annual Increase Cap is categorized as its own type of discount in NFIP calculations. It ensures policyholders don’t experience abrupt shifts from heavily subsidized rates to full actuarial costs.

Conditions That Can Remove the Discount

- A lapse in coverage is the most common reason for losing the Annual Increase Cap

- A building that transitions from under construction to finished construction

- A Policy Form update or correction

- A property address correction, if keyed incorrectly

The Annual Increase Cap is integral to balancing affordability and actuarial soundness, ensuring a smooth rate transition for policyholders without immediate full-cost burdens.

Real Estate Transaction

The New Policy After a Real Estate Transaction rule [2] allows statutory discounts to transfer to a new NFIP policy when a property changes ownership, provided the sale occurred within the last year. Instead of requiring prior declarations pages, eligibility is established using settlement documents or deeds, ensuring continuity of coverage benefits for the new owner.

- Transferable discounts for properties insured under an NFIP policy and sold within the last year.

- Closing paperwork required

- No prior declarations page required