NFIP Map Revision Eligibility: Difference between revisions

No edit summary |

No edit summary |

||

| (63 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

{ | The '''Map Revision Exception''' allows certain NFIP policyholders to qualify for a reduced waiting period when a building's flood zone designation changes due to a FEMA map revision. This exception reduces the standard 30-day waiting period to a '''1-day waiting period''', provided the eligibility requirements are met. | ||

== Eligibility Requirements == | |||

| | To qualify for the Map Revision Exception, the following conditions must be satisfied: | ||

| | |||

{| class="wikitable" | |||

|- | |||

! Requirement | |||

! Description | |||

|- | |||

| FEMA Flood Map Change | |||

| The exception applies only when '''[[NFIP Maps]]''' are revised. | |||

|- | |||

| New SFHA Designation | |||

| The revision results in a building being newly designated within a '''[[Special Flood Hazard Area]]''' where it was previously not in one. | |||

|- | |||

| Application within 13 Months | |||

| The insurer must receive the '''Application Form''' (or endorsement request) and the '''full amount due''' within '''13 months''' from the effective date of the flood map revision. | |||

|- | |||

| Eligible Buildings | |||

| The exception applies to '''all [[Eligibility for NFIP Coverage#Building Eligibility|eligible buildings]]''', including those owned by condominium associations. | |||

|} | |||

<big>'''''<span style="color: #cc3b2a;">If these eligibility requirements are not met, then the Standard 30-day Waiting Period will apply.</span>'''''</big> | |||

== Validation with Flood Zone Determinations == | |||

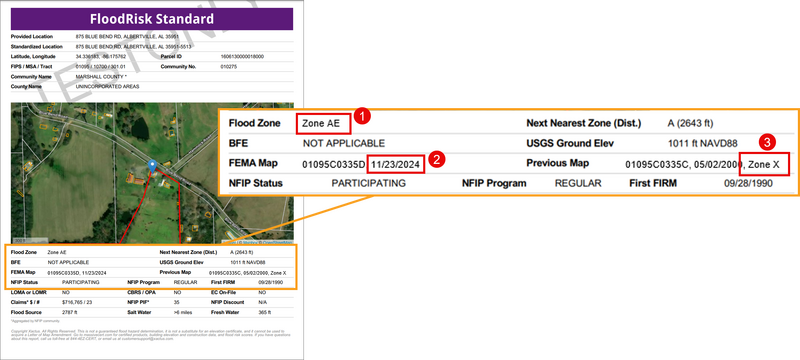

Flood Zone Determinations can be used to validate eligibility for the Map Revision Exception. | |||

[[File:Img-map-rev-01.png|left|800px|link=]] | |||

{{clear}} | {{clear}} | ||

== | Three areas on the document should be reviewed to confirm eligibility. | ||

# Current Flood Zone | |||

# Current Map Revision Date | |||

# Prior Flood Zone | |||

In the image above, the property is eligible for the Map Revision Exception so long as application/request and premium are received before December 24, 2025. | |||

Review the sections below for more information about how these details confirm eligibility. | |||

== Flood Map Changes == | |||

First, there must be a '''Physical Map Revision''' of either a Flood Hazard Boundary Map (FHBM) or a Flood Insurance Rate Map (FIRM). | |||

If the zone is changed by means of a '''Letter of Map Amendment''' (LOMA) or a '''Letter of Map Revision''' (LOMR), then the property does not qualify for the Map Revision Exception. | |||

Also, local zoning and planning offices do not have the authority to authorize NFIP map revisions. A community that equivocates a local map change to an NFIP map change does not grant eligibility for the Map Revision Exception to any property under its jurisdiction. | |||

== New SFHA Designation == | |||

[[File:Img-FEMA-Map Change-01.png|400px|link=]] | |||

Next, the Physical Map Revision must result in a '''zone designation change''' for a specific building. This means that: | |||

# The '''previous flood zone''' did not classify the property within an SFHA. | |||

# The '''updated flood map''' now places the property '''inside an SFHA'''. | |||

<small>''Flood Hazard Boundary Maps do not contain flood zones, so remapping from FHBMs into SFHAs qualifies for Map Revision.''</small> | |||

=== Eligible Scenarios === | |||

{| class="wikitable" | |||

|- | |- | ||

! Before the Map Revision | |||

| | ! After the Map Revision | ||

| | |- | ||

| | | colspan = 2 style="background:#d3eddb;" | '''Example 1: FHBM to FIRM/Zone AE''' | ||

|- | |- | ||

| | | A homeowner’s property was located in an Emergency Program community with a Flood Hazard Boundary Map (FHBM). | ||

| | | A new Flood Insurance Rate Map (FIRM) was created for the community that placed the home in '''Zone AE''' (a SFHA). | ||

| | |- | ||

| | | colspan = 2 style="background:#d3eddb;" | '''Example 2: Zone B to Zone VE''' | ||

|- | |- | ||

| | | A coastal property was in '''Zone B''', which carries a lower flood risk and does not require flood insurance for federally backed loans. | ||

| | | Due to erosion and updated flood modeling, FEMA reclassifies the area as '''Zone VE''', a high-risk coastal flood zone. | ||

|} | |} | ||

=== Ineligible Scenarios === | |||

{| class="wikitable" | |||

|- | |||

| | ! Before the Map Revision | ||

| | ! After the Map Revision | ||

| | ! Criteria for Ineligibility | ||

|- | |||

| colspan = 3 style="background:#FFCB83;" | '''Example 1: FHBM to FIRM/Zone X''' | |||

|- | |||

| A homeowner’s property was located in an Emergency Program community with a Flood Hazard Boundary Map (FHBM). | |||

| A new Flood Insurance Rate Map (FIRM) was created for the community that placed the home in '''Zone X''' (a Non-SFHA). | |||

| Although there was a Physical Map Revision, the property is in a Non-SFHA. NFIP coverage is voluntary. | |||

|- | |||

| colspan = 3 style="background:#FFCB83;" | '''Example 2: Zone AE to Zone VE''' | |||

|- | |||

| A coastal property was in '''Zone AE''', which carries a moderate flood risk. | |||

| Due to erosion and updated flood modeling, FEMA reclassifies the area as '''Zone VE''', a high-risk coastal flood zone. | |||

| The property was already in a SFHA prior to the map revision. | |||

|- | |||

| colspan = 3 style="background:#FFCB83;" | '''Example 3: Zone AE to Zone C''' | |||

|- | |||

| An urban property was in '''Zone AE''', which carries a moderate flood risk. | |||

| Due to community earthworks projects, FEMA reclassifies the area as '''Zone C''', a low risk zone. | |||

| The zone went from a SFHA to a Non-SFHA, making NFIP coverage optional. | |||

|} | |||

== Application and Premium within 13 Months == | |||

Finally, the insurer must receive the Application Form and full premium payment within 13 months of the effective date of the Physical Map Revision. | |||

If the application and payment are submitted after the 13-month window, the property is no longer eligible for the Map Revision Exception, and the standard 30-day waiting period applies. | |||

This deadline is strictly enforced, and no extensions or exceptions are granted. Property owners and agents must verify the FIRM revision date and ensure timely submission to benefit from the 1-day waiting period under this exception. | |||

{| class="wikitable" | |||

!'''Requirement''' | |||

!'''Details''' | |||

|- | |||

|'''Triggering Event''' | |||

|FEMA revises a Flood Insurance Rate Map (FIRM) or Flood Hazard Boundary Map (FHBM), reclassifying a property from a lower-risk flood zone into a Special Flood Hazard Area (SFHA). | |||

|- | |||

|'''Eligibility Window''' | |||

|The NFIP insurer must receive the '''Application Form''' and '''full premium payment''' within '''13 months''' from the map revision’s effective date. | |||

|- | |||

|'''Waiting Period Reduction''' | |||

|If all conditions are met within the 13-month period, the '''standard 30-day waiting period''' is reduced to '''1 day'''. | |||

|- | |||

|'''Late Applications (Beyond 13 Months)''' | |||

|If the policy application and premium payment are received '''after the 13-month window''', the '''30-day waiting period applies''', and the Map Revision Exception does not apply. | |||

|} | |||

== Additional Resources == | |||

* [[Waiting Periods]] | |||

* [[NFIP Effective Date Calculation]] | |||

{{ | {{nfip}} | ||

__NOEDITSECTION__ | |||

Latest revision as of 08:11, 6 February 2025

The Map Revision Exception allows certain NFIP policyholders to qualify for a reduced waiting period when a building's flood zone designation changes due to a FEMA map revision. This exception reduces the standard 30-day waiting period to a 1-day waiting period, provided the eligibility requirements are met.

Eligibility Requirements

To qualify for the Map Revision Exception, the following conditions must be satisfied:

| Requirement | Description |

|---|---|

| FEMA Flood Map Change | The exception applies only when NFIP Maps are revised. |

| New SFHA Designation | The revision results in a building being newly designated within a Special Flood Hazard Area where it was previously not in one. |

| Application within 13 Months | The insurer must receive the Application Form (or endorsement request) and the full amount due within 13 months from the effective date of the flood map revision. |

| Eligible Buildings | The exception applies to all eligible buildings, including those owned by condominium associations. |

If these eligibility requirements are not met, then the Standard 30-day Waiting Period will apply.

Validation with Flood Zone Determinations

Flood Zone Determinations can be used to validate eligibility for the Map Revision Exception.

Three areas on the document should be reviewed to confirm eligibility.

- Current Flood Zone

- Current Map Revision Date

- Prior Flood Zone

In the image above, the property is eligible for the Map Revision Exception so long as application/request and premium are received before December 24, 2025.

Review the sections below for more information about how these details confirm eligibility.

Flood Map Changes

First, there must be a Physical Map Revision of either a Flood Hazard Boundary Map (FHBM) or a Flood Insurance Rate Map (FIRM).

If the zone is changed by means of a Letter of Map Amendment (LOMA) or a Letter of Map Revision (LOMR), then the property does not qualify for the Map Revision Exception.

Also, local zoning and planning offices do not have the authority to authorize NFIP map revisions. A community that equivocates a local map change to an NFIP map change does not grant eligibility for the Map Revision Exception to any property under its jurisdiction.

New SFHA Designation

Next, the Physical Map Revision must result in a zone designation change for a specific building. This means that:

- The previous flood zone did not classify the property within an SFHA.

- The updated flood map now places the property inside an SFHA.

Flood Hazard Boundary Maps do not contain flood zones, so remapping from FHBMs into SFHAs qualifies for Map Revision.

Eligible Scenarios

| Before the Map Revision | After the Map Revision |

|---|---|

| Example 1: FHBM to FIRM/Zone AE | |

| A homeowner’s property was located in an Emergency Program community with a Flood Hazard Boundary Map (FHBM). | A new Flood Insurance Rate Map (FIRM) was created for the community that placed the home in Zone AE (a SFHA). |

| Example 2: Zone B to Zone VE | |

| A coastal property was in Zone B, which carries a lower flood risk and does not require flood insurance for federally backed loans. | Due to erosion and updated flood modeling, FEMA reclassifies the area as Zone VE, a high-risk coastal flood zone. |

Ineligible Scenarios

| Before the Map Revision | After the Map Revision | Criteria for Ineligibility |

|---|---|---|

| Example 1: FHBM to FIRM/Zone X | ||

| A homeowner’s property was located in an Emergency Program community with a Flood Hazard Boundary Map (FHBM). | A new Flood Insurance Rate Map (FIRM) was created for the community that placed the home in Zone X (a Non-SFHA). | Although there was a Physical Map Revision, the property is in a Non-SFHA. NFIP coverage is voluntary. |

| Example 2: Zone AE to Zone VE | ||

| A coastal property was in Zone AE, which carries a moderate flood risk. | Due to erosion and updated flood modeling, FEMA reclassifies the area as Zone VE, a high-risk coastal flood zone. | The property was already in a SFHA prior to the map revision. |

| Example 3: Zone AE to Zone C | ||

| An urban property was in Zone AE, which carries a moderate flood risk. | Due to community earthworks projects, FEMA reclassifies the area as Zone C, a low risk zone. | The zone went from a SFHA to a Non-SFHA, making NFIP coverage optional. |

Application and Premium within 13 Months

Finally, the insurer must receive the Application Form and full premium payment within 13 months of the effective date of the Physical Map Revision.

If the application and payment are submitted after the 13-month window, the property is no longer eligible for the Map Revision Exception, and the standard 30-day waiting period applies.

This deadline is strictly enforced, and no extensions or exceptions are granted. Property owners and agents must verify the FIRM revision date and ensure timely submission to benefit from the 1-day waiting period under this exception.

| Requirement | Details |

|---|---|

| Triggering Event | FEMA revises a Flood Insurance Rate Map (FIRM) or Flood Hazard Boundary Map (FHBM), reclassifying a property from a lower-risk flood zone into a Special Flood Hazard Area (SFHA). |

| Eligibility Window | The NFIP insurer must receive the Application Form and full premium payment within 13 months from the map revision’s effective date. |

| Waiting Period Reduction | If all conditions are met within the 13-month period, the standard 30-day waiting period is reduced to 1 day. |

| Late Applications (Beyond 13 Months) | If the policy application and premium payment are received after the 13-month window, the 30-day waiting period applies, and the Map Revision Exception does not apply. |

Additional Resources