Cancellation Verification Letter: Difference between revisions

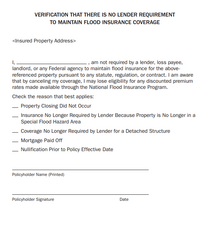

Created page with "The '''Cancellation Verification Letter''' is required when a policyholder requests a cancellation due to their lender no longer requiring flood insurance. The letter serves as documentation that flood insurance is no longer mandated by any lender, loss payee, landlord, or federal agency. Policyholders can obtain the letter from their agent or insurer. === Sample Cancellation Verification Letter === The document includes the following key statements: * The policyholder..." |

No edit summary |

||

| (14 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

The '''Cancellation Verification Letter''' is required when a policyholder requests a cancellation due to their lender no longer requiring flood insurance. The letter serves as documentation that flood insurance is no longer mandated by any lender, loss payee, landlord, or federal agency. Policyholders can obtain the letter from their agent or insurer. | The '''Cancellation Verification Letter''' is required when a policyholder requests a cancellation due to their lender no longer requiring flood insurance. The letter serves as documentation that flood insurance is no longer mandated by any lender, loss payee, landlord, or federal agency. Policyholders can obtain the letter from their agent or insurer. | ||

= | [[File:Img-cxl-verification-letter.png|thumbnail|upright=0.7|Sample Cancellation Verification Letter]] | ||

The document includes the following key statements: | The document includes the following key statements: | ||

| Line 7: | Line 8: | ||

* The policyholder acknowledges that canceling the policy may result in losing eligibility for discounted NFIP premium rates. | * The policyholder acknowledges that canceling the policy may result in losing eligibility for discounted NFIP premium rates. | ||

* The policyholder must select a reason for cancellation, which may include: | * The policyholder must select a reason for cancellation, which may include: | ||

** Property closing did not occur | ** [[Cancellation Qualifying Reasons/RC 07|'''Property closing did not occur''' (RC 07)]] | ||

** [[Cancellation Qualifying Reasons/RC 28|'''Lender No Longer Requires Coverage''' (RC 28)]] | |||

** Coverage | ** [[Cancellation Qualifying Reasons/RC 13|'''Nullification prior to effective date''' (RC 13)]], when a lender is listed on the policy | ||

** Nullification prior to the policy | |||

The letter also requires the policyholder’s '''printed name, signature, and date.''' | The letter also requires the policyholder’s '''printed name, signature, and date.''' | ||

This document is also called the Verification of No Requirement letter or VONR. | |||

{{clear}} | |||

== Additional Resources == | |||

* [https://www.fema.gov/sites/default/files/documents/fema_nfip_flood-insurance-manual_042024.pdf#page=416 Cancellation Verification Letter, ''FIM''] | |||

{{line-nfip-cxl}} | |||

Latest revision as of 13:44, 12 February 2025

The Cancellation Verification Letter is required when a policyholder requests a cancellation due to their lender no longer requiring flood insurance. The letter serves as documentation that flood insurance is no longer mandated by any lender, loss payee, landlord, or federal agency. Policyholders can obtain the letter from their agent or insurer.

The document includes the following key statements:

- The policyholder affirms that they are not required to maintain flood insurance for the insured property under any statute, regulation, or contract.

- The policyholder acknowledges that canceling the policy may result in losing eligibility for discounted NFIP premium rates.

- The policyholder must select a reason for cancellation, which may include:

- Property closing did not occur (RC 07)

- Lender No Longer Requires Coverage (RC 28)

- Nullification prior to effective date (RC 13), when a lender is listed on the policy

The letter also requires the policyholder’s printed name, signature, and date.

This document is also called the Verification of No Requirement letter or VONR.

Additional Resources