Cancellation Qualifying Reasons/RC 01/Sale or Transfer: Difference between revisions

| (31 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

''' | '''Proof of Ownership Transfer for NFIP Cancellations''' | ||

When processing an NFIP policy cancellation due to the sale of a building, underwriters must confirm that ownership has legally transferred. The following guidance clarifies which documents are acceptable as proof of sale and common issues to watch for. | When processing an NFIP policy cancellation due to the sale of a building, underwriters must confirm that ownership has legally transferred. The following guidance clarifies which documents are acceptable as proof of sale and common issues to watch for. | ||

In all cases, the documents must show three elements to be valid for Reason Code 01. | |||

* A '''matching property address''' (or one free of discrepancy) | |||

* The '''seller's name''' on the document must match the name of the NFIP policyholder | |||

* The '''date of the sale''' or transfer | |||

The '''recorded deed''' | Details about the terms of sale/transfer, including the monetary amounts, can be redacted. | ||

== Transfer Deed == | |||

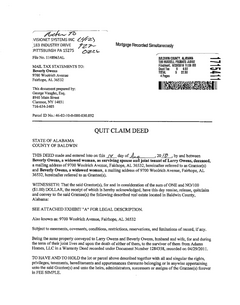

[[File:Img-deed-01.png|right|upright=0.8|thumb|Example Recorded Deed]] | |||

A '''Transfer Deed''' (commonly called a Deed) is the legal document that officially transfers ownership of a property from the seller (grantor) to the buyer (grantee). It includes key details such as the names of both parties, a property description, and the date of transfer. The deed must be '''signed, notarized, and recorded''' with the county recorder’s office to be legally binding. | |||

Unlike a '''Closing Disclosure''' or '''Settlement Statement''' (listed below), which outline financial aspects of the transaction, a recorded deed serves as definitive proof of ownership transfer, making it the '''most reliable document''' for verifying a property sale. | |||

'''Important Details''' | |||

* It contains the '''legal transfer date''' and is filed with the county recorder’s office. | * It contains the '''legal transfer date''' and is filed with the county recorder’s office. | ||

* If available, this document should be used to determine the effective cancellation date. | * If available, this document should be used to determine the effective cancellation date. | ||

'''Issue:''' | '''Issue:''' Deeds often describe the property with a legal address or using [https://en.wikipedia.org/wiki/Metes_and_bounds metes and bounds], which makes it difficult to match to street addresses. | ||

* Look for a line under the legal address that starts as "Commonly Known As" or "Also Known As" | |||

* Do '''not''' use the mailing address shown after the seller's name | |||

== | == Closing Disclosure == | ||

[[File:Img-closing-disclosure-01.png|right|upright=0.8|thumb|Example Closing Disclosure]] | |||

A Closing Disclosure (CD) is a standardized document required for most mortgage transactions, detailing the final terms of a home loan. It provides a breakdown of the loan amount, interest rate, monthly payments, closing costs, and cash-to-close requirements. | |||

Issued by the lender, the CD must be delivered to the borrower at least three business days before closing, ensuring they have time to review the final loan terms. While it confirms the financial aspects of the transaction, it does not serve as definitive proof that a sale has closed, as the legal transfer of ownership is completed with the recorded deed. | |||

'''Important Details''' | |||

* Used in transactions with '''a mortgage'''. | * Used in transactions with '''a mortgage'''. | ||

* Specifies loan details and confirms lender funding. | * Specifies loan details and confirms lender funding. | ||

* Buyer acknowledges receipt '''before closing''', but the document itself does not confirm that closing occurred. | * Buyer acknowledges receipt '''before closing''', but the document itself does not confirm that closing occurred. | ||

'''Issue:''' The transaction is not finalized until the deed is recorded. | '''Issue:''' The transaction is not finalized until the deed is recorded. | ||

{{clear}} | |||

==== Settlement Statement (ALTA or HUD-1) | == Settlement Statement == | ||

[[File:Img-settlement-statement-01.png|right|upright=0.8|thumb|Example Settlement Statement]] | |||

A '''Settlement Statement''' (also known as an ALTA Settlement Statement or HUD-1 for older transactions) is a document that itemizes the financial details of a real estate transaction, including the purchase price, closing costs, prorated taxes, and loan payoffs. It is used in both '''cash and financed transactions''' to show how funds are distributed between the buyer, seller, and other parties. | |||

Unlike the Closing Disclosure, which is required for mortgage loans, a Settlement Statement can be used in cash transactions where no lender is involved. While it provides a detailed financial summary of the closing, it does not confirm the legal transfer of ownership, which is recorded through the deed. | |||

'''Important Details''' | |||

* Used in '''both cash and financed transactions'''. | * Used in '''both cash and financed transactions'''. | ||

* Outlines final fund disbursements for buyer and seller. | * Outlines final fund disbursements for buyer and seller. | ||

| Line 43: | Line 67: | ||

By adhering to these guidelines, underwriters can ensure that NFIP cancellations due to property sales are processed accurately and in compliance with policy requirements. | By adhering to these guidelines, underwriters can ensure that NFIP cancellations due to property sales are processed accurately and in compliance with policy requirements. | ||

== External Resources == | |||

* [https://en.wikipedia.org/wiki/Deed "Deed", ''Wikipedia''] | |||

* [https://atgtitle.com/types-of-property-deeds-and-what-they-mean-2/ The 12 Types of Property Deeds and What They Mean] | |||

* [https://en.wikipedia.org/wiki/HUD-1_Settlement_Statement "HUD-1 Settlement Statement", ''Wikipedia''] | |||

{{line-nfip-cxl}} | |||

Latest revision as of 07:53, 14 February 2025

Proof of Ownership Transfer for NFIP Cancellations

When processing an NFIP policy cancellation due to the sale of a building, underwriters must confirm that ownership has legally transferred. The following guidance clarifies which documents are acceptable as proof of sale and common issues to watch for.

In all cases, the documents must show three elements to be valid for Reason Code 01.

- A matching property address (or one free of discrepancy)

- The seller's name on the document must match the name of the NFIP policyholder

- The date of the sale or transfer

Details about the terms of sale/transfer, including the monetary amounts, can be redacted.

Transfer Deed

A Transfer Deed (commonly called a Deed) is the legal document that officially transfers ownership of a property from the seller (grantor) to the buyer (grantee). It includes key details such as the names of both parties, a property description, and the date of transfer. The deed must be signed, notarized, and recorded with the county recorder’s office to be legally binding.

Unlike a Closing Disclosure or Settlement Statement (listed below), which outline financial aspects of the transaction, a recorded deed serves as definitive proof of ownership transfer, making it the most reliable document for verifying a property sale.

Important Details

- It contains the legal transfer date and is filed with the county recorder’s office.

- If available, this document should be used to determine the effective cancellation date.

Issue: Deeds often describe the property with a legal address or using metes and bounds, which makes it difficult to match to street addresses.

- Look for a line under the legal address that starts as "Commonly Known As" or "Also Known As"

- Do not use the mailing address shown after the seller's name

Closing Disclosure

A Closing Disclosure (CD) is a standardized document required for most mortgage transactions, detailing the final terms of a home loan. It provides a breakdown of the loan amount, interest rate, monthly payments, closing costs, and cash-to-close requirements.

Issued by the lender, the CD must be delivered to the borrower at least three business days before closing, ensuring they have time to review the final loan terms. While it confirms the financial aspects of the transaction, it does not serve as definitive proof that a sale has closed, as the legal transfer of ownership is completed with the recorded deed.

Important Details

- Used in transactions with a mortgage.

- Specifies loan details and confirms lender funding.

- Buyer acknowledges receipt before closing, but the document itself does not confirm that closing occurred.

Issue: The transaction is not finalized until the deed is recorded.

Settlement Statement

A Settlement Statement (also known as an ALTA Settlement Statement or HUD-1 for older transactions) is a document that itemizes the financial details of a real estate transaction, including the purchase price, closing costs, prorated taxes, and loan payoffs. It is used in both cash and financed transactions to show how funds are distributed between the buyer, seller, and other parties.

Unlike the Closing Disclosure, which is required for mortgage loans, a Settlement Statement can be used in cash transactions where no lender is involved. While it provides a detailed financial summary of the closing, it does not confirm the legal transfer of ownership, which is recorded through the deed.

Important Details

- Used in both cash and financed transactions.

- Outlines final fund disbursements for buyer and seller.

- Indicates that closing was planned, but does not confirm the deed was recorded.

Issue: Settlement statements can be revised before closing, meaning the transaction might not yet be complete.

Unacceptable Documents

🚫 Purchase Agreements & Contracts for Sale

- These documents only reflect an intent to sell, not the actual transfer.

- They do not confirm closing or ownership change.

🚫 Estimated Settlement Statements

- Preliminary versions are subject to change and should not be used.

Best Practices

✅ If a recorded deed is available, it should be the primary document used to verify the transfer date.

✅ If a recorded deed is not immediately available, a final Closing Disclosure or Settlement Statement may be used if accompanied by confirmation that the deed has been recorded.

✅ If any document is unclear or appears preliminary, request further documentation from the insured, agent, or county records.

✅ When reviewing cancellation requests, ensure the effective date aligns with the legal transfer of ownership.

By adhering to these guidelines, underwriters can ensure that NFIP cancellations due to property sales are processed accurately and in compliance with policy requirements.

External Resources

- "Deed", Wikipedia

- The 12 Types of Property Deeds and What They Mean

- "HUD-1 Settlement Statement", Wikipedia