|

|

| Line 75: |

Line 75: |

| {{box-summ | | {{box-summ |

| |color = blue | | |color = blue |

| |title = [[File:Icon-info-grey.png|24px|link=]] Policy Effective Date | | |title = [[File:Icon-info-grey.png|20px|link=]] Policy Effective Date |

| |text = | | |text = |

| An NFIP flood policy has a 30-day waiting period provided the premium and the application are received within 10 days of the agent sign date, unless one of the following exceptions apply: | | An NFIP flood policy has a 30-day waiting period provided the premium and the application are received within 10 days of the agent sign date, unless one of the following exceptions apply: |

|

This page may need to be edited based on suggestions or concerns. Read more in the Discussion page.

|

|

|

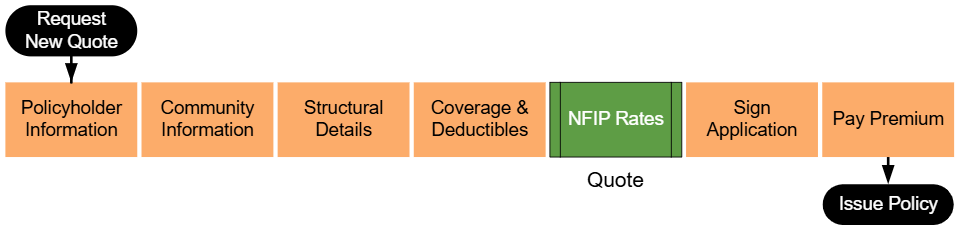

An agent must complete several steps to produce an NFIP application or obtain a quote. Equinox ensures that all required information is collected and validated before the application is submitted. This process is designed to reduce errors and enhance efficiency by guiding the agent through a series of steps that ensure compliance with NFIP guidelines. |

The workflow shown above begins by entering basic property details and continues through collecting additional information about the building, coverage options, and flood zone determinations. At the "NFIP Rates" step, highlighted in green, agents can generate a preliminary quote based on the details provided. This allows the agent to review potential costs before signing the application and collecting premium.

Information Icons Information Icons

|

Equinox has small information icons placed next to important sections or fields. When a user hovers over an icon, a small window provides extra details about that section. The messages from these icons can be found in the collapsible sections below.

|

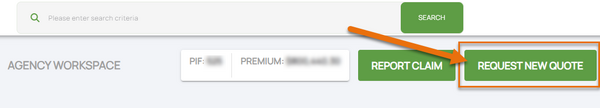

A. Request New Quote

To quote a property with the

NFIP, start in the

Agency Workspace.

Select the "Request New Quote" button near the top of the page.

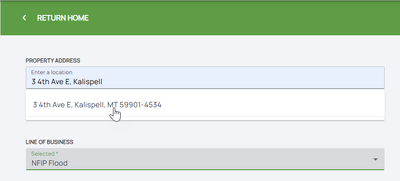

B. Property Address

Enter the property address. A verified address should show from the first dropdown window.

Choose "NFIP Flood" from the second drop down window.

Additional Property Address Details

Start in the Agency workspace by selecting "Request New Quote." Enter the property address, verify it on the map, and choose the line of business (e.g., NFIP Flood).

The address is verified using the

United States Postal Service.

C. Step 1: Basic Information

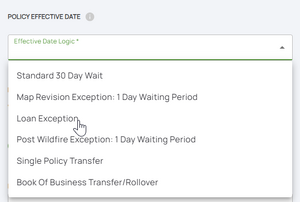

After assigning the property address, the policy effective date and insured details must be entered.

From this point forward, the right side of the page will show a page completion list with the quote/application progress.

Additional Effective Date Details

NFIP quotes are made in real time and rates are subject to change. All quotes must follow the NFIP waiting period rules assigned to new policies. For more information about each

waiting period rule and how to calculate the application effective date, refer to the

Effective Date Calculator.

Policy Effective Date Policy Effective Date

|

An NFIP flood policy has a 30-day waiting period provided the premium and the application are received within 10 days of the agent sign date, unless one of the following exceptions apply:

- Map Revision: A 1-day waiting period may apply if there's been a map provision and the property was previously in a B, C, X, or D zone and is now in an A1 through A30 or V1 through V30 zone. The rezoning must have occurred no more than 13 months prior to today's date.

- Loan Exception: If this policy is being purchased to meet a lender requirement for a new purchase, loan closing, or the increasing, extending, or renewing of a loan, the policy will go into effect at the time of closing provided the application and premium are received in a timely manner.

- Post-Wildfire Exception: A 1-day waiting period applies if the insured property is privately owned and post-wildfire conditions on federal lands caused or worsened the flooding. The insured must have purchased the new policy or additional coverage on or before the fire containment date or during the 60 days following the containment date.

|

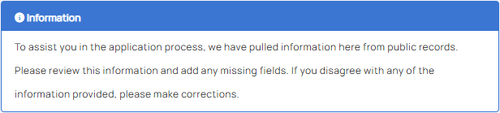

D. Step 2: Third Party Data

The

Third Party Data step pre-populates essential property details from public records.

Agents should review all data for accuracy and manually input any missing or inaccurate information.

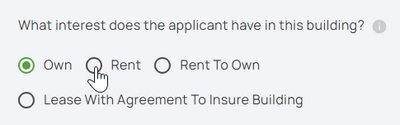

E. Step 3: Property Information

The

Property Information step collects essential details about the property's residential use and the policy's interests.

F. Step 4: Building Type

The Building Type step allows agents to select the building's occupancy type and description. This step uses a button-based interface to simplify the process.

G. Step 5: Foundation Type

The

Foundation Type step uses a series of radio buttons to help agents select the correct foundation type for the building. Clicking on a radio button displays images of foundation types, which can be clicked to finalize the selection.

Agents must also answer a single question about the number of elevators in the building.

H. Step 6: Elevation Certificate Information

The Elevation Certificate Information step requires agents to manually enter key details from an Elevation Certificate (EC).

I. Step 7: Qualifying Questions

The

Qualifying Questions step assesses the

building's eligibility for coverage with the National Flood Insurance Program (NFIP). Agents must confirm that the property meets specific structural and locational criteria, such as the building's structural makeup and location relative to bodies of water.

J. Step 8: Coverage, Deductibles & Discounts

The Coverage, Deductibles & Discounts step allows agents to select policy coverage amounts, choose deductible options, and confirm discount eligibility for the applicant.

K. Step 9: Rates

The Rates step provides a summary of the total annual premium, itemized by coverage type and discounts, and collects final details needed to complete the application.

Next Steps

Once all steps are finished, the NFIP Application is complete.

The next step for Equinox to issue the policy would be to submit premium payment.