Consumer Portal: Difference between revisions

No edit summary |

No edit summary |

||

| Line 30: | Line 30: | ||

{{img-proc-nofrm | {{img-proc-nofrm | ||

|file = File:Img-cportal-12.png | |file = File:Img-cportal-12.png | ||

}} | |||

=== Customer Relationship Management (CRM) === | |||

* Features a direct messaging tool for policyholders to communicate with their agents. | |||

* Displays agent contact information prominently for easy access. | |||

* Ensures agents are notified of any policyholder actions or inquiries. | |||

{{box-summ | |||

|color = yellow | |||

|title = Navigation Tips for Policyholders | |||

|text = Agents should focus on these details when showing the Consumer Portal to their clients. | |||

* Use the dashboard for '''quick access to key actions''', such as making payments or filing claims. | |||

* Keep '''agent contact details''' handy for support with more complex issues. | |||

* Check the '''notifications section''' regularly for updates on policy status or payments. | |||

}} | }} | ||

| Line 48: | Line 63: | ||

* Secure storage ensures privacy and accessibility. | * Secure storage ensures privacy and accessibility. | ||

== Key Features == | == Key Features == | ||

Revision as of 07:19, 17 December 2024

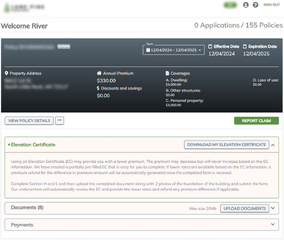

The Consumer Portal empowers policyholders to manage their policies directly while staying connected with their agents for support. It provides a user-friendly interface for accessing policy information, making payments, and submitting requests.

The Consumer Portal is a one-stop shop, empowering policyholders with these features:

|

-

Policy View

-

Policy Documents

-

Claims View

-

Payments with Premium Calculation

Consumer Portal Overview

The Consumer Portal is designed for policyholders to access and manage their policies with ease.

Features include:

- Access to policy details and documents.

- Ability to report claims, request changes, or initiate cancellations.

- Notifications sent via email for actions like renewal reminders or required document uploads.

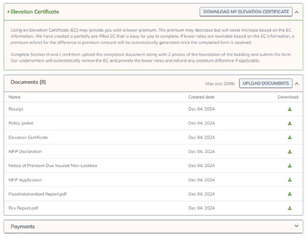

- Integration with Elevation Certificate generation for policyholders to download, complete, and resubmit.

- Displays key details such as policy number, effective dates, and coverage limits.

- Provides a summary of recent activity, including payments and endorsements.

Customer Relationship Management (CRM)

- Features a direct messaging tool for policyholders to communicate with their agents.

- Displays agent contact information prominently for easy access.

- Ensures agents are notified of any policyholder actions or inquiries.

| Navigation Tips for Policyholders |

Agents should focus on these details when showing the Consumer Portal to their clients.

|

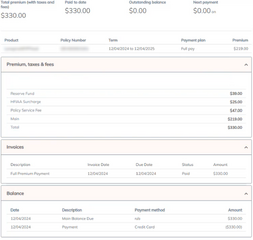

Payment Management

- Enables policyholders to view their billing history and make payments online.

- Supports multiple payment methods for convenience.

- Includes reminders for upcoming payment due dates.

Policyholder Actions

- Request Policy Changes: Allows users to submit requests for changes to their policies, such as updates to coverage or contact details.

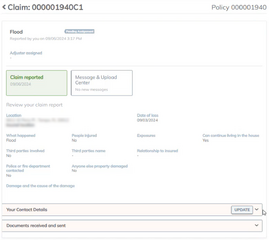

- File a Claim: Provides a guided process for initiating claims directly through the portal.

Document Access

- Policyholders can view and download key documents, such as declarations pages, invoices, and correspondence.

- Secure storage ensures privacy and accessibility.

Key Features

- Policy Overview:

- Displays policy numbers (current, pending, expired).

- Shows details like property address, premiums, discounts, and coverages (dwelling, personal property, etc.).

- Document Management:

- Policyholders can download and upload documents directly from the portal.

- Payments:

- Users can view outstanding balances, upcoming bills, and payment options.

- Plans for enhancements include adding property descriptions and expanding payment plan options.

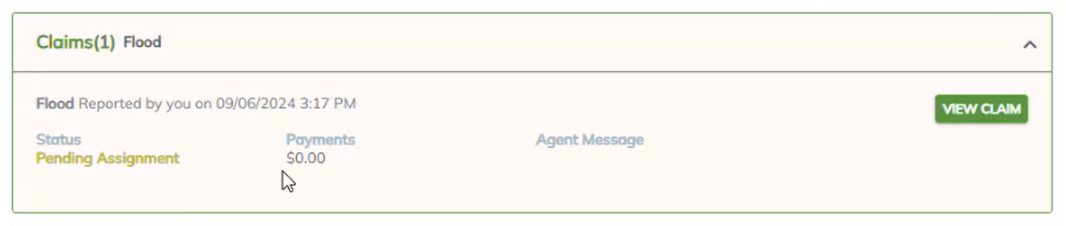

- Claim Management:

- Users can report claims and communicate with examiners or adjusters via a message center.

- Includes document sharing and status updates (e.g., pending assignment or proof of loss).

- Change Requests:

- Allows updates to coverage, deductibles, mortgage information, or insured details.

- Non-monetary changes are auto-issued; monetary changes are sent for underwriter review.

- Cancellation Requests:

- Policyholders can select valid cancellation reasons, attach required documents, and update mailing information for refunds.

- All cancellations require underwriter review, with enhancements planned for automating agent signature collection.

Planned Enhancements

- Electronic Mail: Users can opt-in for electronic communications to reduce physical mail costs.

- Auto-Pay Integration: Potential for adding automatic payment options.

- Agent Notifications: Automated emails for missing signatures or additional required actions.

General Observations

- Upcoming features will further streamline processes and improve user experience.

Key Takeaway

The Consumer Portal is positioned as a user-friendly and efficient tool for policyholders, providing significant advantages over competitors. Enhancements will focus on automation, accessibility, and reducing manual intervention.