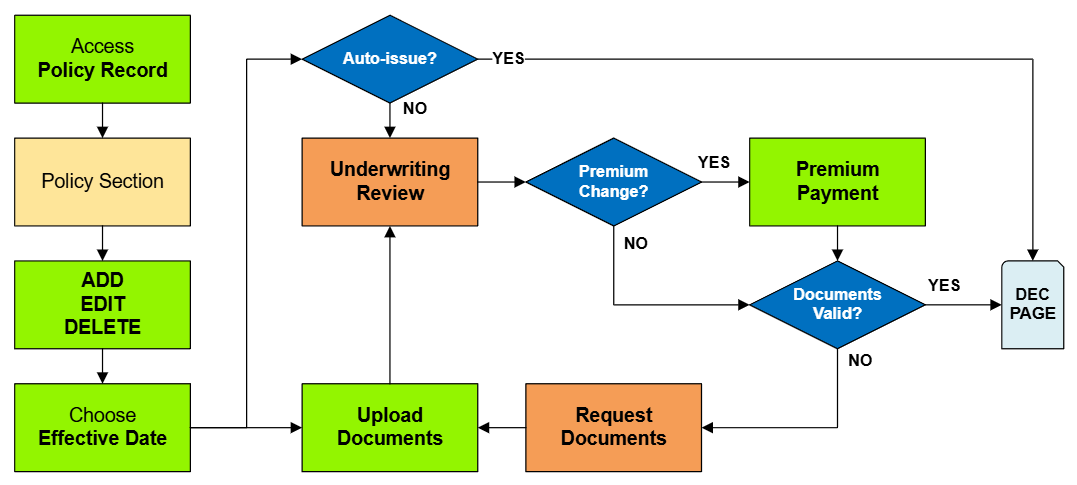

Submit Change to NFIP Policy

This page serves as a directory for various NFIP Policy Changes agents can request through Equinox. Each change type includes details about the process, effective dates, and required documentation. Agents can reference individual procedures for more specific instructions.

|

Policy Changes List

The table below lists the most common NFIP Policy Changes submitted by agents.

- The links in the Policy Section column will show more details about each Policy Change lower on the page.

- The links in the Functions column will go to specific procedural instruction pages.

| Policy Section | Functions | Auto-issue | Documents | Effective Date | NFIP Category |

|---|---|---|---|---|---|

| Primary Insured Contact Details | Edit | Yes | No | Request | Administrative |

| Renewal Billing Instructions | Edit | Yes | No | Request | Administrative |

| Mortgagee Clause | Add, Edit, Delete | Yes | No | Request | Policy Interests |

| Insured Name Correction | Edit | Yes | No | Inception | Administrative |

| Insured Name Update | Edit | No | Yes | Event | Policy Change |

| Additional Insured | Add, Edit, Delete | Yes | Yes | Event or Request | Policy Interests |

| Co-insured | Add, Edit, Delete | Yes | Yes | Event or Request | Policy Interests |

| Policy Assignment | Edit | No | Yes | Event | Policy Interests |

| Coverage Increase | Add, Edit | No | No | Calculated | Coverage Increases |

| Deductible Decrease | Edit, Delete | No | Yes | Calculated | Coverage Increases |

| Coverage Decrease | Edit, Delete | No | Yes | Event or Inception** | Coverage Decreases |

| Deductible Increases | Add, Edit | No | No | Event or Request | Coverage Decreases |

| Elevation Certificate | Add, Edit, Delete | No | Yes | Event or Inception | Rating Adjustment |

| Structural Variables | Edit | No | Yes | Event or Inception | Policy Change |

| Property Address | Edit | No | Yes | Event or Inception | Property Address |

| Effective Date | Edit | No | Yes | Inception | Cancel Rewrite |

| Provisional Rates | Edit | No | No | Inception | Rate Category Change |

Primary Insured Contact Details

| Functions | Auto-issue | Documents | Effective Date | NFIP Category |

|---|---|---|---|---|

| Edit | Yes | No | Request | Administrative |

Edit Only: since the Primary Insured Contact Details are an essential policy detail, they cannot be added or deleted.

Accurate contact information ensures that policyholders receive timely communications regarding their coverage, billing, and claims. Agents can update details such as mailing addresses, phone numbers, and email addresses directly in the system without additional documentation. These changes typically take effect upon request and are processed automatically.

Example: A policyholder wishes to receive their mail at a post office box and provides their updated mailing address. The agent edits the contact details in the system to reflect this change.

▲ Return to the top of the page

Renewal Billing Instructions

| Functions | Auto-issue | Documents | Effective Date | NFIP Category |

|---|---|---|---|---|

| Edit | Yes | No | Request | Administrative |

Edit Only: since the Renewal Billing Instructions are an essential policy detail, they cannot be added or deleted.

Proper billing instructions are crucial for seamless premium payments and uninterrupted coverage. Agents can modify payment methods, billing addresses, or designate third-party payers as needed. These updates are administrative and do not require additional documentation, taking effect upon request.

Example: A policyholder wishes to change their premium payment method from direct billing to mortgage escrow. The agent updates the billing instructions accordingly.

▲ Return to the top of the page

Mortgagee Clause

| Functions | Auto-issue | Documents | Effective Date | NFIP Category |

|---|---|---|---|---|

| Add, Edit, Delete | Yes | No | Request | Policy Interests |

Mortgagee Clauses can be added, edited, or deleted. See Submit Change to Mortgagee Clause.

The mortgagee clause specifies the rights of a lender concerning the insured property. Agents can add, edit, or remove mortgagee information to ensure compliance with loan requirements. While these changes are processed automatically, agents should verify the accuracy of lender details to prevent issues.

Example: A policyholder refinances their mortgage with a new lender. The agent updates the policy to reflect the new mortgagee information.

▲ Return to the top of the page

Insured Name Correction

| Functions | Auto-issue | Documents | Effective Date | NFIP Category |

|---|---|---|---|---|

| Edit | Yes | No | Request | Administrative |

Edit Only: an Insured Name cannot be added or deleted as part of a correction.

Minor errors in the insured's name, such as misspellings, can be corrected to ensure policy accuracy. These corrections are administrative, do not require documentation, and are effective from the policy's inception date.

Example: The insured's name is listed as "Jon Smith" instead of "John Smith." The agent corrects the spelling in the system.

▲ Return to the top of the page

Insured Name Update

| Functions | Auto-issue | Documents | Effective Date | NFIP Category |

|---|---|---|---|---|

| Edit | No | Yes | Event | Policy Change |

Edit Only: an Insured Name cannot be added or deleted as part of a correction.

Required Documentation: legal document showing change to insured name

Significant name changes due to events like marriage or legal name changes require updates to the policy. Agents must obtain legal documentation (e.g., marriage certificate, court order) to process these changes. The updates are not auto-issued and become effective based on the event date.

Example: After legally changing their name, a policyholder provides a court order to the agent, who then updates the policy accordingly.

▲ Return to the top of the page

Additional Insured

This section describes how to add, edit, or remove an additional insured party who has a financial interest in the property. Including all relevant parties ensures comprehensive coverage.

▲ Return to the top of the page

Co-insured

This section explains the process for managing co-insured individuals on a policy, detailing how to add, edit, or delete co-insured parties. Accurately listing co-insured parties ensures that all stakeholders are appropriately covered under the policy.

▲ Return to the top of the page

Policy Assignment

This section outlines the procedure for transferring policy ownership from one party to another, commonly occurring during property sales. Proper assignment ensures continuous coverage for the new owner.

▲ Return to the top of the page

Coverage Increase

This section provides guidance on increasing coverage limits to better protect against potential losses. Requests for coverage increases may require additional underwriting and premium adjustments.

▲ Return to the top of the page

Deductible Decrease

This section explains how to decrease the policy's deductible, which can reduce out-of-pocket expenses in the event of a claim. Lowering the deductible typically results in higher premium costs.

▲ Return to the top of the page

Coverage Decrease

This section covers the process for reducing coverage limits, which may lower premium costs but also decreases the protection level. Careful consideration is advised to ensure adequate coverage remains.

▲ Return to the top of the page

Deductible Increase

This section outlines how to increase the policy's deductible, potentially lowering premium costs. However, higher deductibles mean greater out-of-pocket expenses when filing a claim.

▲ Return to the top of the page

Elevation Certificate

This section discusses the importance of an elevation certificate in determining a property's flood risk and insurance rates. Submitting an accurate elevation certificate can lead to more favorable premiums.

▲ Return to the top of the page

Structural Variables

The building's Structural Variables are found in the Risk Characteristics section of the Policy Record.

Structural Variables can only be Edited, not Added or Deleted.

When a structural variable changes, documentation that proves the change is required.

- The Effective Date for a change is always the date the change occurred (the event date).

When a structural variable needs to be corrected, an agent statement that it was incorrect on the original application is required.

- The Effective Date for a correction is always the policy inception date.

The collapsed table below gives more details about each Structural Variable.

| Structural Variable | FIM | Details |

|---|---|---|

| Primary Residence | ||

| Occupancy* | ||

| Building Description | ||

| Detached Structures | ||

| Building Over Water | ||

| Foundation Type | ||

| Number of Floors | ||

| Number of Units | ||

| Floor of Unit | ||

| Foundation Description | ||

| Number of Elevators |

▲ Return to the top of the page

Property Address

This section provides instructions for updating the property's address information, ensuring that the insured location is correctly identified. Accurate address details are crucial for policy accuracy and claims processing.

▲ Return to the top of the page

Effective Date

This section explains how to adjust the policy's effective date, which determines when coverage begins or changes take effect. Timely updates to the effective date are essential to maintain continuous coverage.

▲ Return to the top of the page

Provisional Rates

NFIP policies issued with Provisional Rates [1] cannot be renewed. So provisionally-rated policies must be endorsed prior to the policy expiration date. Claims will also not be paid on policies with provisional rates; therefore, these policies must be endorsed before a claim payment is issued.

An agent can issue New Business or a Renewal term with Provisional rates; however, the NFIP strongly suggests that the insurer endorse the policy within 60 days of issuance. Additional premium may be required as part of this Rating Category Change.

▲ Return to the top of the page